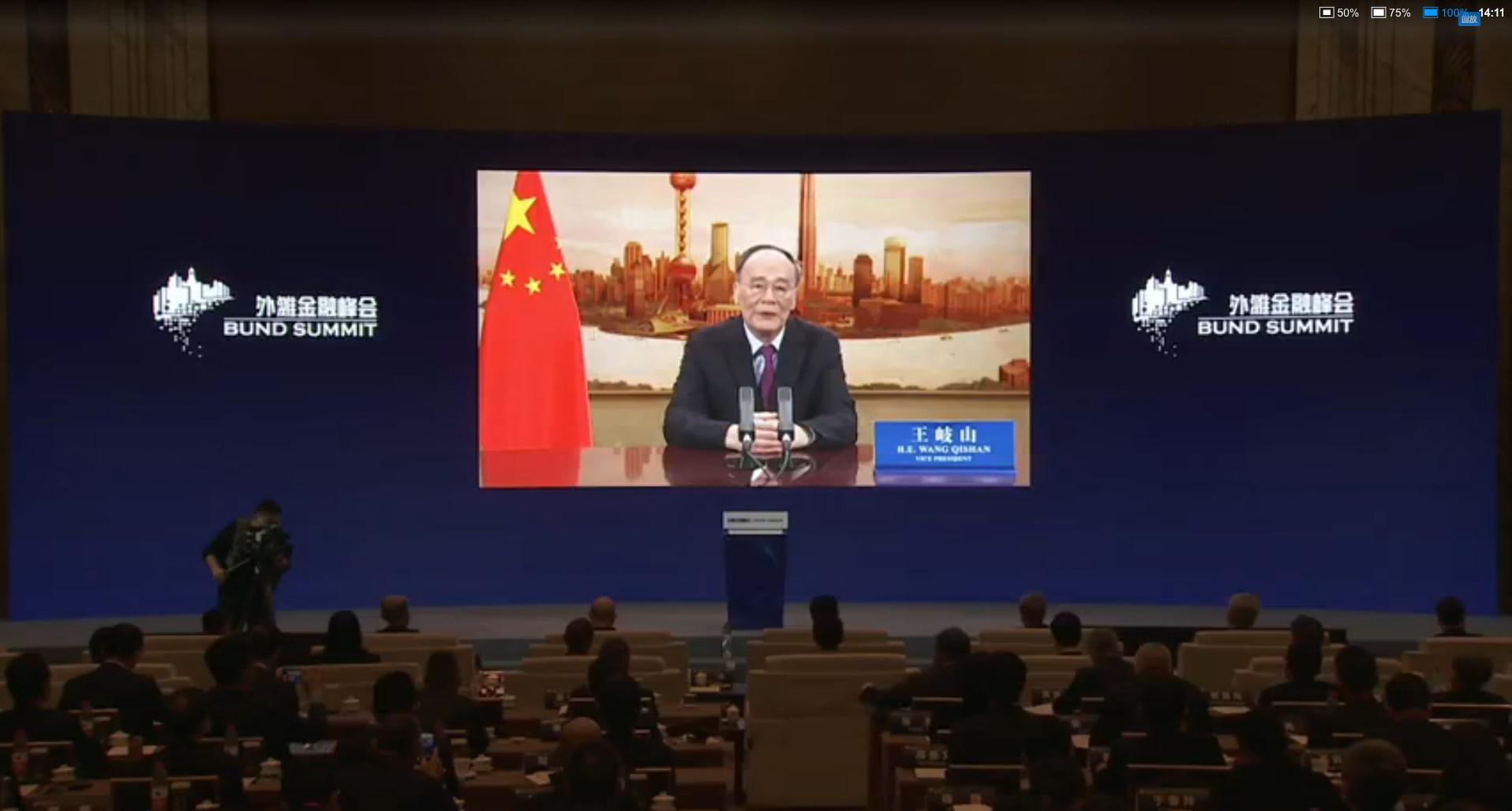

Financial Sector Should Avoid ‘Wrong Paths’ of Speculation, Bubbles and Ponzi Schemes, Vice President Says

China’s finance industry should stay off the “wrong paths” of speculation, self-circulating financial bubbles and Ponzi schemes, Vice President Wang Qishan told a financial summit on Saturday.

The industry should serve the real economy and focus on preventing financial risks, Wang said in a pre-recorded speech presented to the Bund Summit in Shanghai.

Wang made his remarks as China pushes ahead with its efforts to prevent systemic risks in the financial sector that have been created by high debt levels, many companies’ immature risk control, and underregulation of emerging areas such as internet finance.

He said that the finance industry should pay close attention to companies’ operations and support the economy’s key areas and weak links, adding that of the industry’s three key principles — security, liquidity and effectiveness — the most important is always security.

Meanwhile, it is necessary to strengthen the industry’s capabilities to ensure that it can withstand challenges posed by market competition amid opening-up, changes of economic cycles and external impact, he said.

In recent years, as new financial technologies have been broadly applied, new businesses have emerged which have brought convenience and high-efficiency but also magnified risks. Striking a balance between innovation, opening-up and regulatory capacity is essential, he said.

Regarding China’s economy, Wang said that it has entered a “high-quality development stage” and that the country will further pursue its strategy of “dual circulation” (双循环) with a focus on domestic circulation, he said.

The theme of dual circulation was first mentioned by President Xi Jinping in May. Although no specific details have been released, broadly speaking, the strategy involves making the economy more reliant on “internal circulation” — the domestic cycle of production, distribution and consumption — for its development, while being supported by “external circulation,” which relates to international trade and investment and China’s links with the rest of the world.

Read more

Five Things to Know About ‘Dual Circulation’

Four Things to Watch as China’s Leaders Map Out the Next Five Years

Wang said that domestic demand has made a greater contribution to economic growth in recent years as international momentum weakened. China should further push forward supply-side structural reform and continue to expand domestic demand, he suggested.

To accommodate the new development model, China should shift its growth focus from being factor-driven to innovation-driven, as well as shifting from being investment-driven to both consumption- and investment-driven, Wang said.

China will also work to clear deep-rooted institutional obstacles to have the market play its role in the allocation of resources, Wang said. That will help foster a more international and convenient business environment that adheres more to the rule of law, he said.

China’s top leaders will discuss their proposals for the next five-year plan, covering 2021 to 2025, at a key meeting from Monday to Thursday, with Xi’s dual circulation strategy likely to take center stage to help the economy overcome medium- and long-term challenges.

Tang Ziyi contributed to this report.

Contact reporter Timmy Shen (hongmingshen@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- GALLERY

- PODCAST

- MOST POPULAR